work opportunity tax credit questionnaire required

A couple of jobs I have applied for have required me to complete the Work Opportunity Tax Credit as part of my application process. Work Opportunity Tax Credit WOTC Frequently Asked Questions.

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Are employees required to fill out WOTC form.

. Questions and answers about the Work Opportunity Tax Credit program. Are employees required to fill out WOTC form. The very first question is Are you under age 40 How is this legal.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. WOTC is authorized until December 31 2025 Section 113 of Division EE of PL. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website.

The employee groups are those that have had significant barriers to employment. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

Work Opportunity Tax Credit questionnaire. I was under the impression that employers were not allowed to ask about age because it is a slippery slope to discriminating on the basis of age. The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups.

After the required certification is secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against their payroll taxes. No Tax Knowledge Needed. This tax credit may give the employer the incentive to hire you for the job.

1 Legal Form library PDF editor e-sign platform form builder solution in a single app. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. Updated on September 14 2021. Participation in the WOTC program is voluntary on behalf of employees and employers.

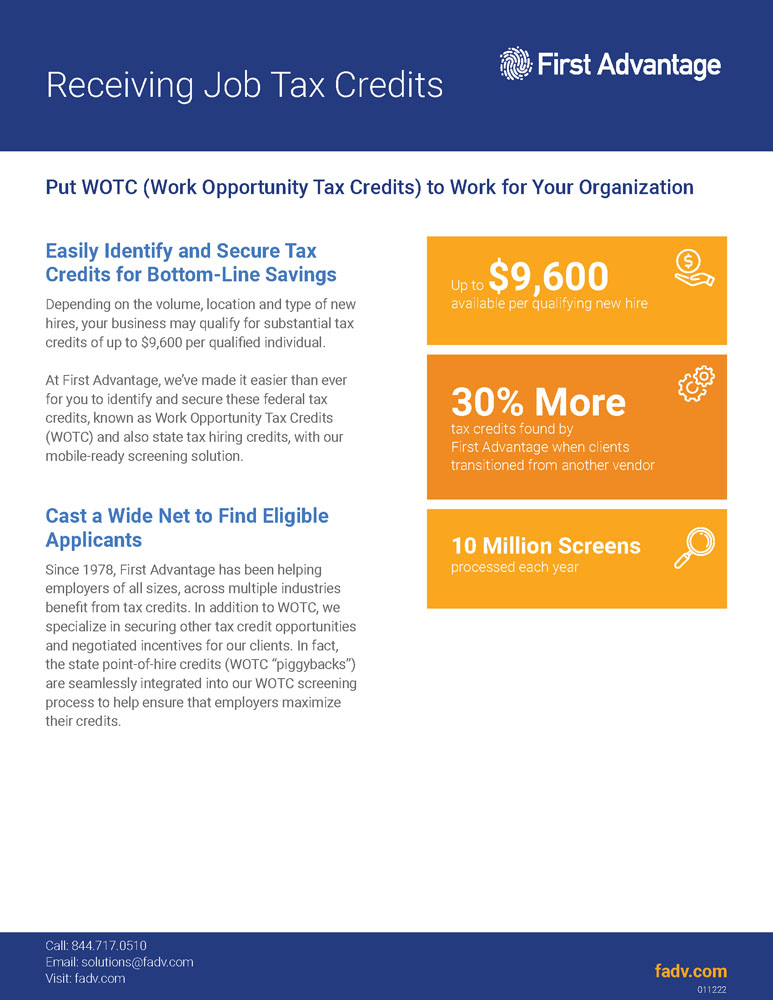

Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file. It is not a requirement for either party. The WOTC program not only creates a positive impact on the nations unemployment levels but also affords business owners the incredible opportunity to earn between 2400 and 9600 for each eligible new hire.

File With Confidence Today. Page one of Form 8850 is the WOTC questionnaire. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions.

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. This tax credit program has been extended until December 31 2025. Employers file Form 5884 to claim the work opportunity credit for qualified 1st- or 2nd-year wages paid to or incurred for.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. There are two sets of frequently asked questions for WOTC customers. The answers are not supposed to give preference to applicants.

These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our websites chat box that we try to answer. Is participating in the WOTC program offered by the government.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. 116-260 -- Consolidated Appropriations Act 2021.

Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. WOTC Improve Your Chances of Being Hired The Work Opportunity Tax Credit WOTC can help you get a job. Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US.

In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. If you are in one of the target groups listed below an employer who hires you could receive a federal tax credit of up to 9600. Answer Simple Questions About Your Life And We Do The Rest.

Below you will find the steps to complete the WOTC both ways. Completing Your WOTC Questionnaire.

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

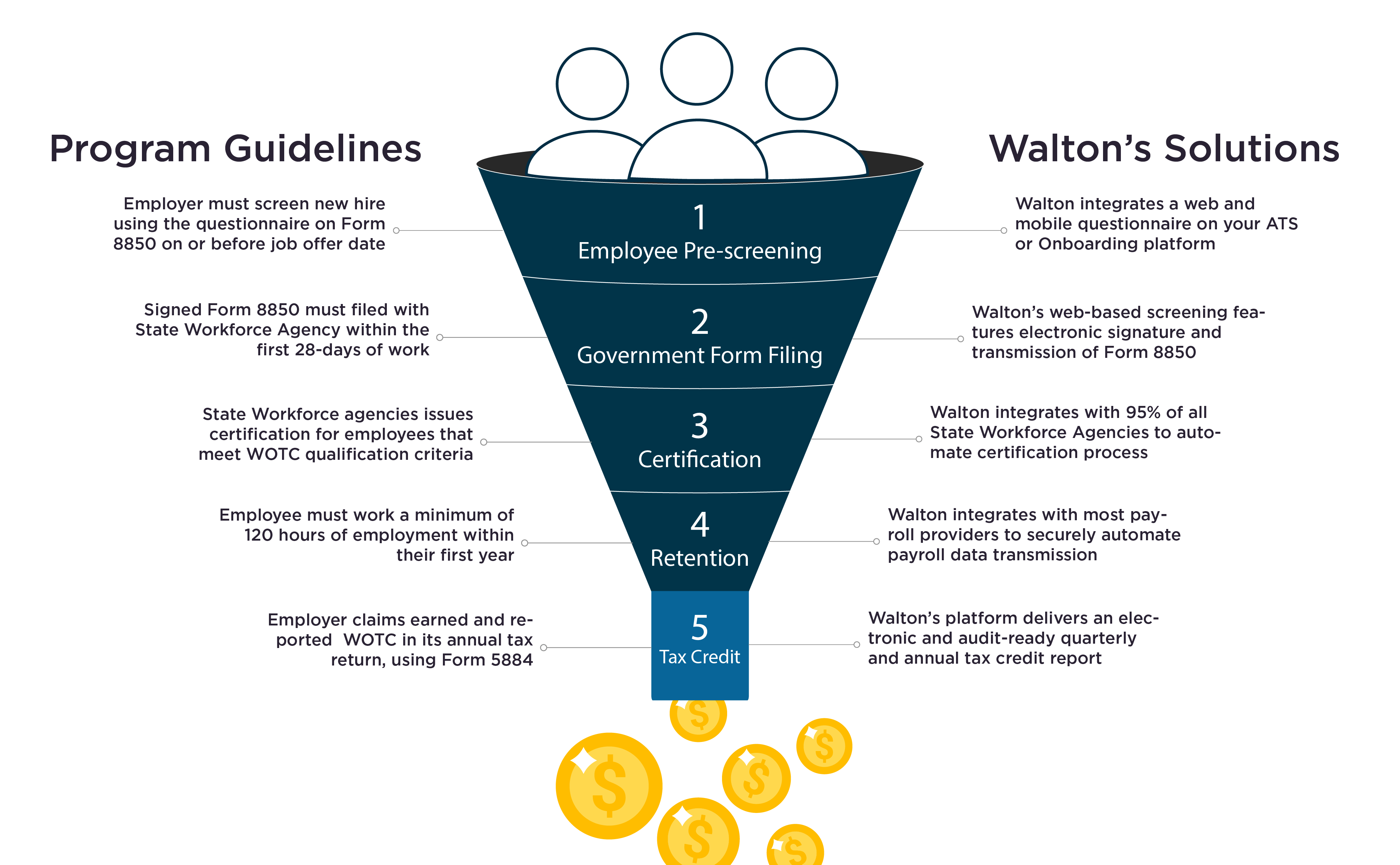

Work Opportunity Tax Credits Wotc Walton

Work Opportunity Tax Credits Wotc Walton

Retrotax Tax Credit Administration Jazzhr Marketplace

Work Opportunity Tax Credit What Is Wotc Adp

With Wotc Timing Is Everything Wotc Planet

Work Opportunity Tax Credit First Advantage

What Is Tax Credit Screening On Job Application

Wotc Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptech Com

Wotc Hiring Credits Work Opportunity Tax Credit Comprehensive Guide Emptech Com

Completing Your Wotc Questionnaire

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller