virginia tesla tax credit

Learn More About BMW Electric Vehicles Now. Virginia SNAP EBT Card Benefits for September 2022 Inflation Reduction Act Means 87000 New IRS Agents.

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

1 day agoThe enhanced child tax credit provided up to 300 monthly checks per kid to parents for six months.

. Federal Tax Credits To begin the federal government is offering several tax incentives for drivers of EVs. With the tax credit vehicles purchased in the United States will still be 5000 cheaper due to the tax credit bill take the 10000 tax credit and subtract the 5000 price. 20 hours agoA Canadian man went viral after claiming the battery in his 140000 Tesla died and that a replacement would 26000.

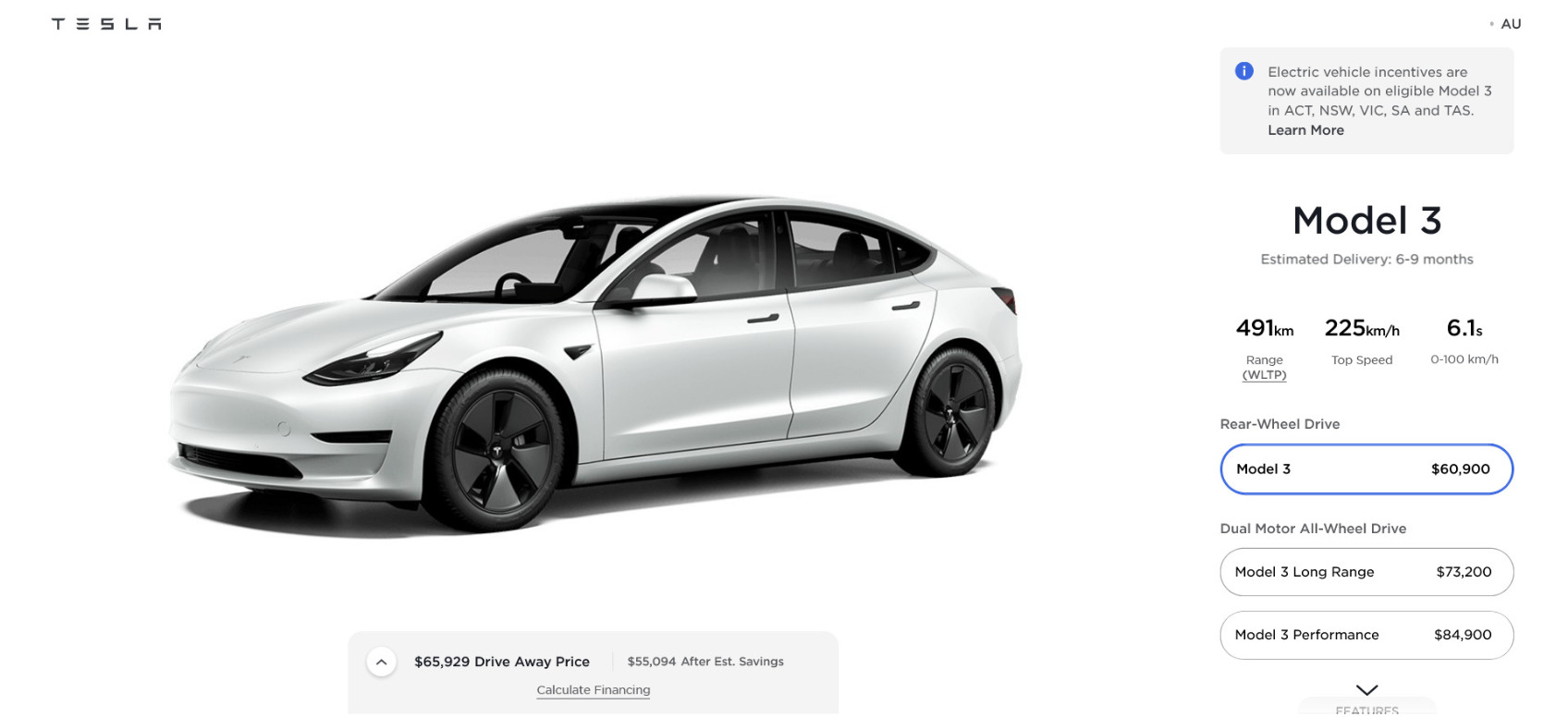

Luxury Performance in Perfect Harmony. If successfully passed the law could provide up to a 7500 tax credit for the Tesla Model 3 Standard Range and the Model Y so long as the buyer meets certain income limits. Youve Never Met a Vehicle that Looks or Drives Like this.

Learn More About BMW Electric Vehicles Now. Virginia Governor Ralph Northam has signed a bill which will require car manufacturers to sell a certain percentage of electric or hybrid vehicles. The 2022 Virginia General Assembly passed a law earlier this year giving taxpayers with a liability a rebate of up to 250 for individual filers and up to 500 for joint filers.

You get a 7500. Ad The Electric Side of BMW. The Consolidated Appropriations Act of 2021 signed December 27 2020.

Joe Manchin of West Virginia. Youve Never Met a Vehicle that Looks or Drives Like this. 3 days ago.

Tesla Tax Credit Virginia. Beginning January 1 2022 a resident of the Commonwealth who purchases a new. 20 hours agoListen to article.

Claim the credit against the following taxes administered by Virginia Tax. Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns. Virginia Tax Credits Review the credits below to see what you may be able to deduct from the tax you owe.

Unless Im misunderstanding something it. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the. Electric vehicle and battery manufacturing tax credits.

Ad Browse Pictures See Specs Hyundais Electric Cars Like The Ioniq Kona Electric More. Essentially if you install a home EV charging station the tax credit under the Inflation Reduction Act is 30 of the cost of hardware and installation up to 1000. Luxury Performance in Perfect Harmony.

With the investment tax credit ITC now referred to as the Residential Clean Energy Credit for residential systems you can reduce the cost of your PV solar energy system by 30 percent. Virginia extends the state gross single axle tandem axle or bridge formula weight limits by an additional 2000 lbs in total for vehicles that run either partially or fully on natural gas. 6 Ways To Avoid an Audit.

But resistance from Republicans and Sen. The part about a base price of not more than 55000 seems really concerning. Virginia tesla tax credit Monday August 8 2022 Edit Currently Tesla and GM are no longer eligible for the 7500 federal tax credit for EVs because they have hit the 200000 unit.

Energy storage paired with solar systems are considered qualified expenditures eligible for the tax credit. This credit may range from 2500 to 7500 and is intended to make it more. Communities of Opportunity Tax Credit COPTC The Communities of Opportunity Program COP is a Virginia income tax credit program enacted by the 2010 General Assembly.

All 36 charger spots taken for the first time at the. 2024 Chevrolet Equinox EV confirmed at 30000 for 250-mile base model. With the lifting of the popularity penalty several sought after EVs will once again be eligible for the 7500 Federal EV Tax Credit in 2023 including some Tesla models.

Ad Tesla tax credit virginia. Effective October 1 2021 until January 1 2027 Eligibility for rebate. Check Out the Latest Info.

Food Stamps Schedule. 1 minute Tesla is pausing its plans to make battery cells in Germany as it looks at qualifying for US. 17 hours agoThe 2022 Appropriations Act established a one-time tax rebate for eligible taxpayers for up to 250 for individuals and 500 for couples.

Browse Our Collection and Pick the Best Offers. A 500 income tax credit for each new green job created. I am in the market for a Tesla in NoVa and also looking into this.

Mario Zelaya known as supermariozelaya posted. In addition to credits Virginia offers a number of deductions and subtractions. It sounds like if approved the bill would give a 10 State tax credit up to 3500 on the purchase of a BEV not a plug-in Hybrid effective January 1st 2018 for the next 5 years.

Ad The Electric Side of BMW.

Tesla Model S Specs Tesla Model S Tesla Motors Model S Tesla

Tesla Model 3 Renderings With A Bunch Of New Paint Jobs Gallery Tesla Model Tesla Tesla Car

A Tesla In Every Garage Not So Fast Ieee Spectrum

Tesla Tax Rebate Could Make A Comeback Thanks To Senate Deal

Forget Those Tesla Crashes Gm Says You Can Trust Its Autonomous Vehicles General Motors Is Racing To Electrify Its Va In 2022 Autonomous Vehicle Self Driving Vehicles

Elon Musk Says Tesla Is Shifting More Electric Cars To Lfp Batteries Over Nickel Supply Concerns Electrek

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

Which Tesla Models Qualify For The Ev Tax Credit In 2023 Leafscore

Electric Vehicle Buying Guide Kelley Blue Book

Image Result For Tesla Model 3 Tesla Model Tesla Tesla Electric Car

The Continuous Glass Roof Of The Tesla Model 3 Tesla Tesla Motors Otomobil

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Tesla Wait Times Stretch Out To 2023 But Is It Really Only Rich People Who Buy Them

Tesla Model 3 Tax Write Off 2021 2022 Best Tax Deduction

Which Tesla Models Qualify For The Ev Tax Credit In 2023 Leafscore

Tesla Model 3 Second Ride Review Tesla Model Tesla Tesla Model S